ETG Calculator Explained:

When you invest money, you are not chasing numbers on a screen. You are trying to answer one simple question. What will this decision mean for your future? Most people search for an ETG calculator because they feel stuck between hope and confusion. They see percentages, projections, and promises, but nothing feels concrete.

This guide exists to fix that gap. It explains what an ETG actually does, how expected total gain is calculated, and how you can use the results for real financial planning. By the end, you will know how to estimate returns with confidence, avoid common mistakes, and decide whether an investment outcome truly makes sense for you. The goal is clarity, not complexity, and one honest answer you can trust.

If you already use online tools to simplify calculations, pairing ETG results with a structured SIP calculator can help you plan long-term contributions more realistically

Table of Contents

What Is an ETG Calculator and What Does Mean in Finance

ETG stands for Expected Total Gain. In finance, it represents the total profit you expect to earn from an investment over a defined period, after subtracting your original capital.

An ETG calculator is a tool that turns abstract growth rates into real numbers. Instead of asking “What percentage return is good,” it answers “How much money will I actually gain.”

This distinction matters more than people realize.

A 10 percent return sounds attractive. But 10 percent on 10,000 and 10 percent on 1,000,000 lead to very different outcomes. ETG focuses on outcomes, not impressions.

According to wikipedia’s in Financial Returns

That is why ETG calculators are often used as:

- Expected returns calculators

- Investment gain calculators

- Total profit estimators

- Financial gain calculators

All of these tools aim to answer the same underlying question: what does growth look like in real money terms?

Why an ETG Calculator Matters More Than You Think

Most financial mistakes do not happen because people avoid planning. They happen because people plan using the wrong lens.

Here is what usually goes wrong without an ETG:

- Percentages hide real impact

- Time is underestimated

- Compounding is misunderstood

- Growth assumptions are too optimistic

An ETG forces reality into the picture.

Simple real-world example

You invest 150,000 for 12 years at an average annual growth of 7 percent.

Without a calculator, you might think, “That should roughly double.”

An ETG calculator shows:

- Final value ≈ 337,000

- Expected total gain ≈ 187,000

That difference affects education planning, retirement timelines, and risk tolerance.

This is why ETG tools are increasingly used as wealth growth calculators and investment outcome calculators rather than quick ROI checks.

How Does an ETG Calculator Work Behind the Scenes

Even though ETG look simple, the logic behind them is precise.

Core inputs you provide

- Initial investment amount

- Growth or interest rate

- Investment duration

- Compounding frequency

What happens internally

- The calculator applies the growth rate to your capital

- Growth compounds based on frequency

- The process repeats for each time period

- Final value is calculated

- Original investment is subtracted

Understanding the math behind ETG becomes easier when you are familiar with calculation-based tools, similar to how structured solvers like an RREF calculator break complex problems into steps.

What you see as output

- Final investment value

- Expected total gain

- Gain percentage

This same engine powers most portfolio gain calculators, projected gain calculators, and return estimation tools.

For users who invest monthly rather than once, pairing ETG thinking with a SIP calculator provides better insight into real accumulation over time:

ETG Calculation Formula Explained in Plain Language

You do not need financial training to understand the compounding growth formula. You just need to understand what each part represents.

Standard compound growth formula

Final Value = Initial Amount × (1 + Growth Rate) ^ Time

Expected Total Gain = Final Value − Initial Amount

Practical example

- Initial investment: 80,000

- Annual growth rate: 9 percent

- Time period: 6 years

Final value ≈ 135,000

Expected total gain ≈ 55,000

That 55,000 is your ETG.

This exact logic appears in financial projection calculators, expected earnings calculators, and asset growth estimators across platforms.

How to Use an ETG-Calculator Correctly

Using an ETG calculator takes seconds. Using it wisely takes intention.

Step-by-step calculator usage

- Enter the amount you will actually invest

- Use a growth rate based on realistic expectations

- Match the time period to your real goal

- Select correct compounding settings

- Review both gain and final value

Practical tip

Never rely on a single rate. Run two scenarios:

- A conservative estimate

- An optimistic estimate

This gives you a range instead of false certainty, which is far more useful for planning.

| Scenario | Growth Rate | Final Value | Expected Total Gain |

|---|---|---|---|

| Conservative | 6% | Lower | Realistic baseline |

| Optimistic | 10% | Higher | Best-case outcome |

Practical rule:

If both scenarios still support your goal, the investment is likely sensible.

ETG Calculator for Beginners: Where Most People Get Stuck

If you are new to investing, ETG calcullators can feel intimidating. The problem is not the math. It is interpretation.

Common beginner confusion

- Mixing up gain and final value

- Using unrealistic growth rates

- Ignoring time horizon

- Expecting guarantees

Simple rule for beginners

If the number feels too good to be true, it probably is.

Calculator ETG for beginners work best when treated as learning tools, not promises. Over time, you will develop intuition around what realistic expected returns look like. Beginners often rush through numbers the same way they misread basic metrics like age or timelines, which is why tools such as an online age calculator help reinforce accuracy habits.

ETG Calculator for Expected Returns and Planning Confidence

Expected returns are estimates, not predictions. This Calculator helps you visualize what those estimates mean in practical terms.

Why this matters

Two investments may both show 12 percent expected returns. But if one requires double the time or capital, the expected total gain tells a different story.

Using this calculator for expected returns allows you to:

- Compare scenarios fairly

- Understand trade-offs

- Align investments with real goals

This is where ETG tools outperform simple ROI calculators.

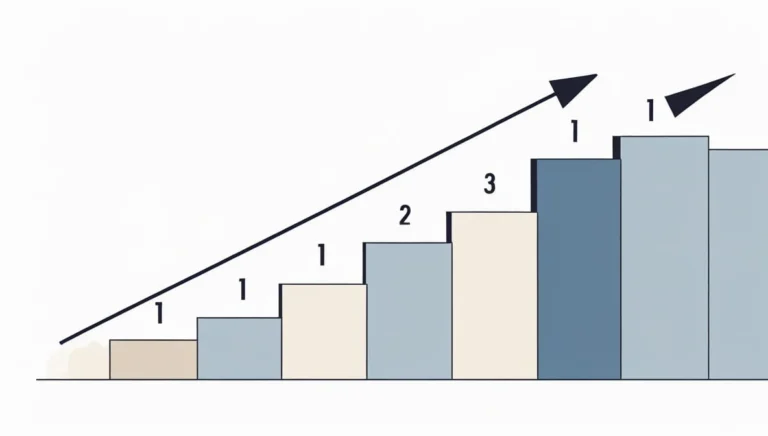

ETG Calculator for Long Term Investments

Long-term investing is where ETG provide the most value.

Small differences in growth rates compound dramatically over time.

Example: 20-year horizon

- Investment: 300,000

- Growth rate: 8 percent

Final value ≈ 1,398,000

Expected total gain ≈ 1,098,000

That outcome is impossible to intuit without calculation.

ETG for long term investments help answer questions like:

- When can I retire

- How much should I invest now

- What happens if returns drop slightly

This clarity reduces emotional decision-making.

| Time Horizon | ETG Impact | Risk Visibility | Planning Value |

|---|---|---|---|

| 1–3 years | Low to moderate | Limited | Tactical |

| 5–10 years | Strong | Clear | Strategic |

| 15–25 years | Massive | Very clear | Life planning |

Insight:

ETG becomes more powerful as time increases. Long-term planning without ETG is mostly guesswork.

Long-term projections feel abstract until you break them into measurable stages, much like planning financial independence using a Coast FIRE calculator.

ETG Calculator With Annual Growth Explained Clearly

Most ETG calculations assume annual growth unless stated otherwise.

What annual growth means

It means returns are applied once per year and then compounded.

Why this matters

If growth is compounded monthly instead of annually, results change significantly over long periods.

Always confirm:

- Growth frequency

- Compounding interval

This detail alone can shift expected total gain by thousands.

ETG Calculator for Savings Growth

This calculators are not only for stocks or aggressive investments.

They work equally well as savings growth calculators.

Example

- Savings: 200,000

- Annual interest: 5 percent

- Time: 4 years

Expected total gain ≈ 43,000

This helps you decide:

- Whether to lock funds

- Whether returns justify restrictions

Savings decisions feel small, but ETG makes their impact visible.

| Use Case | Savings ETG | Investment ETG |

|---|---|---|

| Growth speed | Slow | Faster |

| Risk level | Low | Medium to high |

| Predictability | High | Variable |

| Planning confidence | Stable | Scenario-based |

| Best for | Capital protection | Wealth growth |

Clarity point:

Same ETG calculator, different mindset. Savings protect. Investments expand.

For conservative scenarios, ETG outputs align closely with tools designed for steady accumulation, such as a gratuity calculator used for long-term employment benefits.

ETG Calculator for Financial Planning Decisions

Financial planning is about trade-offs. ETG calculators help you see those trade-offs clearly.

You can use ETG results to:

- Prioritize goals

- Balance risk and reward

- Adjust timelines

This is why ETG tools are often classified as financial planning calculators rather than pure investment tools.

Financial planning works best when gains are viewed alongside liabilities, which is why combining ETG insights with a loan EMI calculator and gratuity calculators help contextualize cash flow alongside creates a clearer cash flow picture.

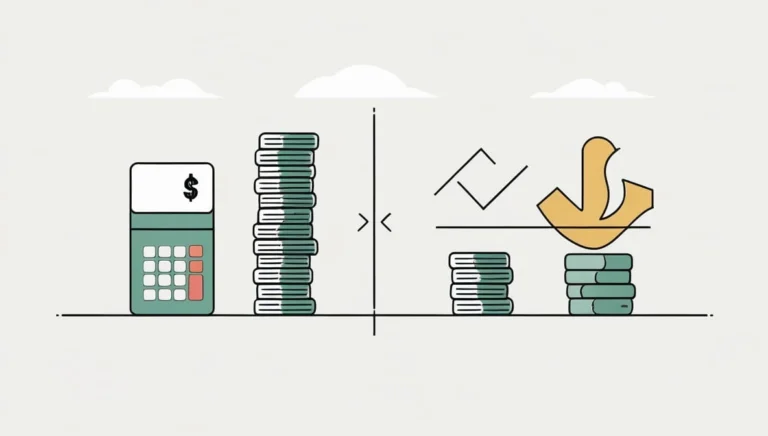

ETG Calculator vs ROI Calculator: A Practical Comparison

People often confuse these tools, but they serve different purposes.

ROI calculator

- Focuses on efficiency

- Expressed as a percentage

ETG calculator

- Focuses on outcome

- Expressed in real money

ROI helps compare investments. ETG helps plan life decisions.

Used together, they provide a complete picture.

| Factor | ETG Calculator | ROI Calculator |

|---|---|---|

| Primary focus | Total money gained | Percentage return |

| Output clarity | Shows real profit amount | Shows efficiency only |

| Best for | Financial planning decisions | Comparing investments |

| Time impact | Clearly visible | Often underestimated |

| Beginner friendly | Yes, very | Can be misleading |

| Decision support | High | Medium |

Quick takeaway:

ROI tells you how good an investment looks. ETG tells you what it actually gives you.

ETG Calculator vs Simple and Compound Interest Calculators

Simple interest calculators

- Linear growth

- Rare in real investments

Compound interest calculators

- Growth on growth

- Foundation of ETG tools

ETG calculators build on compound interest logic but emphasize the final gain rather than just future value.

| Aspect | ETG Calculator | Compound Interest Calculator |

|---|---|---|

| Main goal | Expected total gain | Future value |

| Shows profit separately | Yes | No |

| Planning usefulness | High | Medium |

| Beginner understanding | Easier | Slightly technical |

| Used for | Outcomes & decisions | Mathematical growth |

Why this matters:

Both use compounding, but ETG is outcome-driven, not formula-driven.

Is an ETG Calculator Reliable

This is one of the most important questions.

Short answer

Yes, mathematically. No, predictively.

What ETG calculators do well

- Apply formulas correctly

- Remove guesswork

- Show impact of time and rate

What they cannot do

- Predict markets

- Adjust for taxes automatically

- Account for inflation unless specified

ETG calculators are reliable estimation tools, not forecasting guarantees.

This limitation applies to all financial forecasting calculators.

| Factor | Improves Accuracy | Reduces Accuracy |

|---|---|---|

| Realistic growth rate | ✅ | ❌ |

| Long-term horizon | ✅ | ❌ |

| Inflation awareness | ✅ | ❌ |

| Blind optimism | ❌ | ✅ |

| Single-scenario planning | ❌ | ✅ |

Reality check:

ETG calculators are honest. Inputs decide whether results are useful or misleading.

Reliability improves when tools explain assumptions clearly, similar to how transparent calculators like the terminus calculator define start and end logic.

Common ETG Calculation Mistakes and How to Avoid Them

Mistake 1: Using best-case growth rates

Fix: Use historical averages.

Mistake 2: Ignoring compounding frequency

Fix: Match rate with frequency.

Mistake 3: Confusing gain with total value

Fix: Read results carefully.

Mistake 4: Overconfidence in estimates

Fix: Recalculate regularly.

Avoiding these mistakes makes ETG calculators genuinely useful.

Misreading outputs is a common issue across tools, whether it is returns or even content metrics, which is why clarity-focused utilities like a word counter tool exist.

When You Should Not Rely Solely on an ETG Calculator

Do not rely on ETG alone when:

- Risk levels differ significantly

- Investments are tax sensitive

- Cash flow timing matters

In these cases, ETG should be one input, not the decision itself.

| Situation | ETG Alone | Needs More Analysis |

|---|---|---|

| Fixed deposits | ✅ | ❌ |

| Long-term SIP | ✅ | ❌ |

| Stock picking | ❌ | ✅ |

| Tax-heavy investments | ❌ | ✅ |

| Retirement planning | ⚠️ | ✅ |

What Makes a Good Free ETG Calculator

A trustworthy free ETG calculator should offer:

- Transparent formulas

- Clear inputs

- Instant calculation

- No hidden assumptions

Avoid tools that show results without explaining how they were derived.

ETG Calculator Results Explained Without Confusion

Focus on three outputs:

- Initial investment

- Expected total gain

- Final value

Start with the gain. Then ask whether the final value supports your goal. Percentages are secondary.

Final Thoughts

An ETG calculator does not tell you what to invest in. It tells you what an investment decision could realistically mean over time. Used correctly, it replaces hope with understanding and guesswork with clarity. Treat it as a planning ally, not a promise, and it will serve you well.

About the Author

Written by a financial content strategist focused on simplifying investment concepts for real-world decision making. The work centers on clarity, practical tools, and long-term usefulness rather than hype or speculation.