SIP Calculator

Calculate returns on your systematic investments

SIP Projection

Intro SIP Calculator Tool:

Want to know how much wealth you can build with a monthly SIP? Whether you’re just starting your investment journey or fine-tuning your portfolio, our SIP Calculator Tool gives you instant answers. It helps you calculate SIP returns accurately—showing how much you’ll receive by investing a fixed amount every month for a specific period at a certain interest rate.

A Systematic Investment Plan (SIP) is a smart and disciplined way to invest in mutual funds. But many people ask: “What is SIP calculator tool and how does it work?” SIP lets you invest a fixed sum regularly—monthly or quarterly—into mutual fund schemes, helping you benefit from rupee cost averaging and the power of compounding.

For example, if you’re wondering “How much will I get if I invest ₹5000 monthly for 5 years in SIP?” — our SIP calculator tool does the math in seconds. Just enter your investment amount, duration, and expected annual return, and get a complete breakdown of your total investment, estimated returns, and maturity amount.

Designed for simplicity, speed, and precision, this SIP calculator is ideal for beginners, salaried individuals, and even experienced investors planning long-term goals like retirement, child education, or a dream house.

Table of Contents

💡 1. What is a SIP Calculator Tool?

A SIP calculator Tool (Systematic Investment Plan) is a financial tool used to estimate how much wealth you can create by investing a fixed amount monthly in mutual funds or other financial instruments over a period of time.

It simplifies your investment planning using this compound interest sip calculator formula:

FV = P × {[(1 + r)^n – 1] / r} × (1 + r)

Where:P= monthly investment,r= monthly interest rate,n= total months

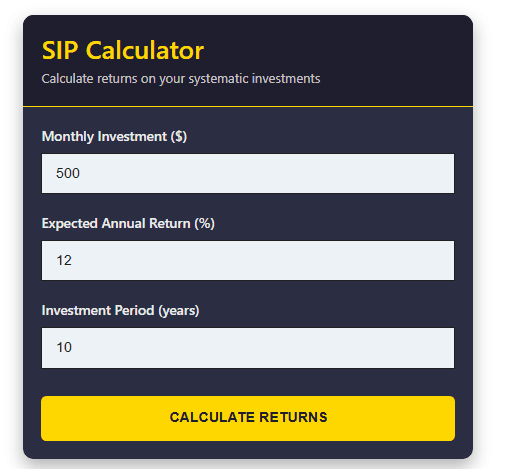

🧰 2. Overview of Minitoollab SIP Calculator Tool

Minitoollab provides a free, browser-based SIP calculator Tool that:

- Requires no sign-up

- Has a clean, beginner-friendly UI

- Gives instant and accurate projections

- Allows experimentation with investment amount, rate of return, and tenure

📝 3. How It Works: Step-by-Step Guide

Here’s how you can use it in under 1 minute:

- Enter Monthly SIP Amount

(e.g., ₹5,000 or $100) - Set Expected Annual Return Rate

(e.g., 12% for equity mutual funds) - Select Investment Tenure

(e.g., 10 years = 120 months) - Click “Calculate”

- Output: Total invested, interest earned, and maturity value

You can try different combinations and visualize how slight changes impact your wealth.

🌟 4. Key Benefits of Using a SIP Calculator Tool

| Feature | Benefit |

|---|---|

| 🔄 Scenario Testing | Try different investment strategies |

| 📊 Visual Understanding | See the impact of compounding clearly |

| ⏱️ Time-Saving | No manual calculation or Excel needed |

| 🎯 Goal Planning | Align SIPs with life goals |

| 📉 Risk Awareness | Helps manage return expectations realistically |

💵 5. Real-Life Example: SIP in Action

Let’s say:

- Monthly SIP: ₹5,000

- Expected Return: 12% p.a.

- Duration: 15 years

Results:

- Total Invested = ₹9,00,000

- Final Amount ≈ ₹23,48,000

- Interest Earned = ₹14,48,000

💬 This shows how your investment grows nearly 2.5x due to compounding and disciplined investing!

👥 6. Who Should Use This Tool?

- Beginner investors: Just starting with mutual funds

- Students: Learning about compound interest sip calculator

- Working professionals: Planning long-term wealth

- Parents: Estimating savings for a child’s education

- Retirees: Checking potential retirement corpus

📉 7. SIP Calculator Tool vs Manual Calculation

| Manual | SIP Tool |

|---|---|

| Complex formulas | No math required |

| Time-consuming | Instant results |

| Error-prone | Accurate projections |

| Limited visualization | Clear interest vs investment breakdown |

🧠 8. Additional Tips for Smart Investing

- ✅ Start early—even small SIPs compound well over time

- ✅ Review your SIP yearly to match your income growth

- ✅ Diversify SIPs across mutual funds (equity + debt)

- ✅ Consider inflation when setting long-term goals

- ✅ Use the SIP calculator Tool every 6 months for updated projections

🧾 11. Final Thoughts

The Minitoollab SIP calculator tool is a great starting point for anyone planning their financial future. It combines simplicity with insight, giving you the power to test, compare, and optimize your SIP journey.

By using this tool regularly, you’ll make informed decisions and stay on track with your wealth-building goals.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Consult a certified financial advisor before making investment decisions.

Frequently Asked Questions (FAQ’s):

1. What is a SIP calculator Tool?

A SIP (Systematic Investment Plan) calculator is an online tool that estimates the future value of your regular (monthly/quarterly) investments into mutual funds. It uses compound interest sip calculator formulas to forecast projected returns based on your input amount duration, and assumed rate of return

2. How does a SIP calculator work?

It uses the formula:

FV = P × [ (1 + r)^n – 1 ] × (1 + r) / r,

where P = monthly investment, r = periodic rate (annual rate / 12), n = total months invested

3. How accurate are SIP calculator estimates?

They offer approximate returns based on assumptions. Actual returns may vary due to market fluctuations, fund expenses, and taxes. They should be used for planning, not as guaranteed outcomes .

4. What inputs are required?

You typically need to enter:

Monthly SIP amount

Expected annual return rate

Investment duration (in months/years)

5. Can SIP calculators guarantee future returns?

No. These tools provide estimates only. Since mutual fund returns fluctuate, actual results may differ significantly .

6. What is the importance of the expected rate of return?

The expected return largely influences projected corpus. A higher assumed rate increases estimated returns—but also raises risk. Use conservative and realistic return assumptions for better planning .

7. Is there a minimum or maximum SIP amount or tenure?

Minimum: As low as ₹100–₹500/month depending on fund house .

Maximum: No fixed upper limit; tenure can be from a few months to decades—even indefinite perpetual SIPs

8. Can I change or stop my SIP?

Yes, you can modify or pause SIPs anytime. Some funds allow flexible or step-up SIPs; others may allow changes only at tenure-end. Always check the scheme’s terms .

9. Does the SIP calculator account for inflation?

Standard calculators show nominal returns. They do not adjust for inflation. For real (inflation-adjusted) returns, use additional tools or calculators

10. Can I use this for various fund types?

Yes—most SIP calculators support equity, debt, hybrid funds, index funds, ELSS, and others. Some platforms also include features like goal-based or step-up SIP calculations

11. What are different SIP calculator variants?

Regular SIP: Fixed monthly investment.

Step‑Up SIP: Annual increment added to SIP amount. Useful to counter inflation

Target Amount Calculator: Calculates required SIP to reach a specific goal

12. What additional features do some calculators offer?

Graphical representation of returns vs investments.

Scenario analysis—adjusting rate, amount, or duration.

Fund recommendations based on goals (e.g., ET Money)

13. How do I check actual realized returns (XIRR vs CAGR)?

CAGR is good for lump-sum investments but not precise for SIPs.

XIRR calculates actual annualized returns considering varied investment dates—ideal for SIP tracking

14. What common mistakes should I avoid?

Overestimating expected returns

Ignoring inflation and fees

Using unrealistic durations or expectancies